property tax loans florida

The states average effective property tax rate is 083 which is lower than the US. If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Check your actual property tax bill incorporating any tax exemptions that pertain to your real estate.

. Quick Online From - Simple 3 Minute Form - Get Started Now - Connect with a Lender. Paying Taxes With a Mortgage. At a 083 average effective property tax rate property taxes in Florida rank below the national average which currently stands at 107.

Fast Easy Form. Get Low-Interest Personal Loans Up to 50000. Cash for any purpose Same Day Approval Over 300 Lenders.

Maybe you arent informed about your property levy showing a higher rate than appropriate according to your propertys actual value. The typical homeowner in Florida pays 2035 annually in property taxes although that amount varies. Please consider AHL Hard Money Network when your taxes are late or you are at risk of losing your property.

There are three main phases in taxing real estate ie devising tax rates estimating property values and taking in tax revenues. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Property taxes are customarily sent off in advance for the entire year.

While private lenders who offer conventional loans are usually not required to do that. Then funds are allocated to these taxing entities based on a standard plan. We always look for reputable property tax lenders to add to our Floridas vendor list.

Real property ownership switches from the seller to the. Ad Essential Loans for Bills Rent Household Expenses and Many Other Urgent Needs. If Florida property tax rates have been too high for your wallet causing delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in Florida.

So who pays property taxes at closing when buying a house in Gainesville. While observing constitutional limitations prescribed by statute the city creates tax rates. Whenever you pay someones taxes you do not qualify for ownership.

Cant Qualify For A Loan. Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. Florida PACE Funding Agency.

Over 100 Million Customer. The Florida Department of Revenue is authorized by law Section 21305319. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Then ask yourself if the amount of the increase is worth the time and effort it requires to challenge the. We can handle loans from 10K to 100K or more if you have a free and clear property in. Lenders often roll property taxes into borrowers monthly mortgage bills.

This may happen because property market values are set collectively in. Check your real property tax payment including any exemptions that apply to your real estate. The property tax sale process for properties with unpaid taxes is handled according to Florida law so it works the same way in every Florida county.

When going to court. PACE loans are property assessed clean energy PACE programs that allow a property owner to finance energy efficient or wind resistance improvements through a non-ad valorem assessment repaid. FPFA is an interlocal agreement created and established as a separate legal entity public body and unit of government pursuant to Section 16301 7 g Florida Statutes with all of the privileges benefits.

It all starts when you dont pay your. Ad Were Americas 1 Online Lender. Can Someone Take Your Property By Paying The Taxes In Florida.

Ad All Credit Types OK Fast Request Form Funding in 24 hrs No Upfront or Hidden Fees. The list includes taxpayers who have unsatisfied tax warrants or. 6650 Professional Pkwy STE 102 Sarasota FL 34240.

The Florida Small Business Emergency Bridge Loan Program provides relief to any small businesses that sustained financial loss due to COVID-19. The list is updated monthly. The most common examples are.

Ad Our bridge loans make it easy to purchase rehab investment properties. Well Help You Get Started Today. Income will be consistent between the Internal Revenue Code and the Florida Income Tax Code.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. However sections 3 and 4 Chapter 2021-242 Laws of Florida provide for decoupling from. The program is available in all Florida.

How Can You Get Loans For A Tax Deed Property. Ad Were Americas 1 Online Lender. We can handle loans from.

Documents that transfer an interest in Florida real. Top REIs across the country are growing their portfolios with confidence Kiavi. Well Help You Get Started Today.

What looks like a large increase in value may actually result in a tiny hike in your tax payment. 4411 Bee Ridge Rd 134 Sarasota FL 34233. Need help paying property taxes in Broward County Florida.

Apply for a quick loan to pay your property tax bill and receive up to 5 loan quotes from the best Broward County property tax lenders. As will be covered further appraising property billing and collecting payments conducting compliance.

Real Estate Lingo Deciphered What S A Comp Via Florida Luxury Homes Group Realtor Realestate Isellb Home Equity Loan Home Equity Home Improvement Loans

Florida Property Tax H R Block

Florida Usda Home Loans 1st Florida Mortgage

Property Taxes How Much Are They In Different States Across The Us

What Is A Homestead Exemption And How Does It Work Lendingtree

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

Your Guide To Prorated Taxes In A Real Estate Transaction

A Summary Of The Florida Intangible Personal Property Tax

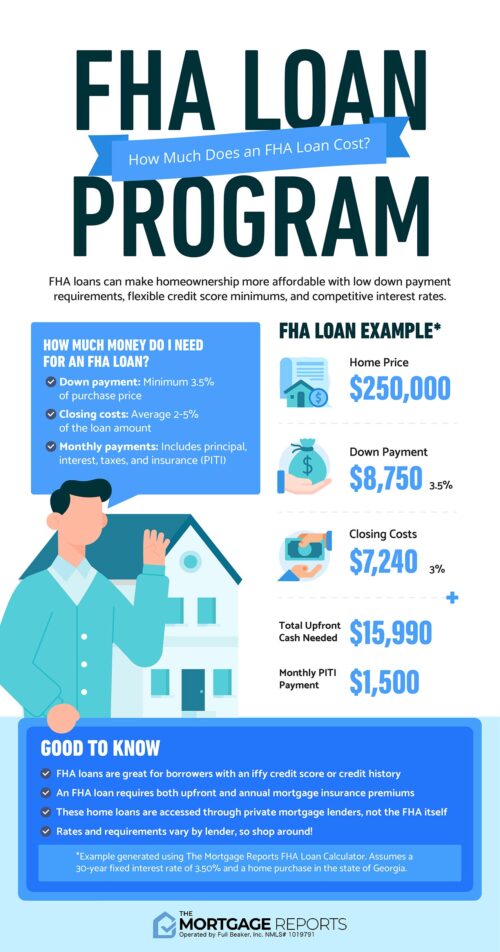

Fha Loan Calculator Check Your Fha Mortgage Payment

Real Estate Blog Mortgage Payment Property Tax Florida Real Estate

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

How Taxes On Property Owned In Another State Work For 2022

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)